Your favorite pizza chain can track a $15 order from kitchen to doorstep in real-time, complete with notifications, GPS tracking, and quality checks. Yet many Fortune 2000 companies with billions in revenue can’t tell you where their critical contracts are stored, what obligations they contain, or when they expire. This striking contrast highlights a serious business problem. Contract management risks aren’t just theoretical concerns—they represent real threats to your organization’s financial health, legal standing, and operational efficiency.

Every day, contract managers and legal departments grapple with an ever-growing volume of agreements. According to PwC, the average Fortune 1000 company maintains between 20,000 and 40,000 active contracts at any given time. Without proper systems in place, these critical documents often end up scattered across shared drives, email inboxes, and even physical filing cabinets.

The consequences? Significant and far-reaching. From missed renewals to overlooked obligations, the ripple effects of inadequate contract management touch every aspect of your business. Let’s examine the seven most critical risks you face when contract management falls short—and how you can address each one effectively.

Risk #1: Financial Vulnerability and Revenue Leakage

Imagine discovering that your organization has been consistently bleeding revenue without anyone noticing. It’s a reality for many companies with poor contract management. Research shows that an average of 9.2% of annual revenue is lost due to contract mismanagement.

This financial vulnerability manifests in multiple ways:

- Missed payment deadlines resulting in late fees and penalties

- Overlooked price increases that should have been implemented

- Untracked volume discounts and rebates

- Unauthorized discounts given without proper approval

- Auto-renewals of services no longer needed

- Incomplete delivery of contracted services without corresponding price adjustments

How to Manage Financial Contract Risk

Addressing financial contract risk begins with visibility. Implementing a centralized contract repository with automated extraction of key financial terms creates a foundation for proper oversight. Set up automatic alerts for upcoming payment milestones, renewal dates, and price adjustment opportunities.

Regular contract audits can identify discrepancies between negotiated terms and actual implementation. Consider establishing a cross-functional review team that includes finance, procurement, and legal to ensure all financial implications are properly monitored and enforced.

By converting your contracts from static documents into active financial instruments, you transform potential leakage points into value-capture opportunities.

Risk #2: Legal and Regulatory Exposure

The legal implications of poor contract management extend far beyond everyday business concerns. Companies can face fines up to €20 million or 4% of global turnover for non-compliance with regulations like GDPR. A single overlooked clause or missed deadline can trigger severe consequences.

Consider these scenarios:

- A missed termination notice window locks your company into another year of an unfavorable agreement

- Failure to implement required security measures specified in a contract leads to data breaches and regulatory penalties

- Inconsistent application of standard terms across agreements creates contradictory obligations

- Inability to verify regulatory compliance across your contract portfolio during an audit

- Overlooked changes in regulations that affect existing contractual obligations

Contract risk and compliance issues don’t just affect the legal department—they create company-wide exposure that can threaten your organization’s very existence.

Building Compliance into Your Contract Risk Management Process

Create a library of pre-approved clauses that meet regulatory requirements and protect your interests. Implement compliance checkpoints at critical stages of the contract lifecycle.

Regular compliance reviews should scan existing contracts against current regulatory requirements, identifying gaps that need to be addressed. When regulations change, your system should help identify affected agreements and prioritize remediation efforts.

Contract risk management tools can automatically flag high-risk provisions and regulatory issues during contract creation and review, helping your team address potential problems before they become actual liabilities.

Risk #3: Operational Inefficiencies and Process Bottlenecks

The hidden costs of operational inefficiency often go unrecognized until they’ve severely impacted your business. 40% of a contract’s value can disappear due to inefficiencies in contract management. These inefficiencies manifest in numerous ways:

- Extended approval cycles that delay project starts and revenue recognition

- Duplicated effort as multiple team members recreate information that should be readily available

- Manual data entry errors that cause downstream problems

- Inconsistent processes that vary by department or contract type

- Valuable staff time spent on low-value administrative tasks instead of strategic work

- Delayed business decisions due to inability to access contract information quickly

These inefficiencies don’t just slow down operations—they fundamentally undermine your organization’s ability to execute on its objectives and compete effectively.

Streamlining Operations to Overcome Contract Management Challenges

Addressing operational challenges of contract management requires both process redesign and technological support. Start by mapping your current contract processes to identify bottlenecks, redundant steps, and approval delays.

Standardize workflows for different contract types to create consistency and predictability. Implement automated routing and approval processes that keep contracts moving through the system without manual intervention.

The most effective solutions combine template libraries, electronic signatures, guided workflow processes, and real-time status tracking to eliminate unnecessary delays and resource waste. By transforming your contract process, you can recapture that lost 40% of value and redeploy those resources toward growth initiatives.

Risk #4: Security Vulnerabilities and Data Privacy Concerns

Contracts often contain your organization’s most sensitive information—pricing structures, intellectual property details, confidential business strategies, and personal data. When contract management fails, this critical information becomes vulnerable to unauthorized access, data breaches, and misuse.

The security implications include:

- Contracts stored in unsecured locations accessible to unauthorized personnel

- Lack of access controls allowing anyone to view sensitive contractual information

- No audit trail of who has accessed contract information and when

- Inability to enforce need-to-know principles for sensitive agreements

- Contracts containing personal data without proper protection measures

- No centralized way to identify all contracts containing specific types of sensitive information

Implementing Security Controls in Contract Risk Management

Protecting your contract data requires a multi-layered approach to security. Begin by centralizing all contracts in a secure repository with robust access controls and encryption. Implement role-based permissions that restrict access to contracts based on business need.

Maintain comprehensive audit logs that track all contract access and modifications. Regularly review these logs to identify potential security concerns. Establish data retention policies that ensure contracts are securely archived or destroyed when no longer needed.

Consider implementing data loss prevention technology that can identify when sensitive contract information is being shared inappropriately. By treating your contracts as the valuable assets they are, you build a security framework that protects your organization’s most important information.

Risk #5: Damaged Business Relationships and Reputation

Business relationships thrive on trust and consistency. When contract management breaks down, so do these critical relationships. Missing deadlines, failing to deliver on promises, or disputing terms due to poor documentation creates friction that can permanently damage your reputation.

These relationship impacts include:

- Missed deadlines that force business partners to adjust their plans

- Inconsistent fulfillment of contractual obligations causing frustration

- Dispute escalation due to inadequate contract documentation

- Perception of disorganization that undermines confidence in your business

- Repeated issues that signal your organization doesn’t value the relationship

- Lost renewal opportunities when partners choose more reliable alternatives

While difficult to quantify, the relationship damage from poor contract management often exceeds the direct financial impacts by creating long-term opportunity costs.

Relationship Management as a Key Component of Contractual Risk Management

Establish clear ownership of each contract relationship with designated responsibility for monitoring and fulfilling obligations. Create a systematic approach to tracking commitments and ensuring they’re met on time.

Proactive communication about upcoming deadlines and potential issues helps maintain trust even when challenges arise. Regular relationship reviews can identify areas for improvement before they become problems.

The most successful organizations view contract risk management as a relationship-building tool rather than just a compliance exercise. By consistently meeting your obligations and demonstrating reliability, you build the trust that leads to expanded business opportunities.

Risk #6: Limited Contract Visibility and Control

You can’t manage what you can’t see. Many organizations still lack full visibility of their contractual obligations. This blindness creates fundamental vulnerabilities:

- Inability to quickly locate specific contracts when needed

- No central inventory of all active agreements

- Limited awareness of upcoming renewal or expiration dates

- Fragmented understanding of obligations across different departments

- Difficulty tracking performance against contractual requirements

- Poor insights into contract trends and patterns across the organization

Gaining Visibility with Contract Risk Management Tools

Addressing the visibility challenge starts with creating a complete inventory of all existing contracts. This baseline enables you to identify gaps and establish proper controls. A centralized repository with robust search capabilities ensures you can find any contract when needed.

Contract risk management software enables automated extraction of key terms, dates, and obligations, transforming static documents into actionable intelligence. Calendar integration and automated alerts ensure upcoming deadlines are never missed.

Reporting and analytics capabilities provide management insights into contract patterns, risks, and opportunities. With proper visibility, you convert your contract portfolio from an administrative burden into a strategic asset.

Risk #7: Strategic Decision-Making Limitations

When contract information is scattered and incomplete, leadership makes decisions based on partial information. This handicaps strategic planning and prevents your organization from leveraging its full contractual potential.

The strategic limitations include:

- Inability to analyze spending patterns across vendors

- Limited visibility into contractual commitments for future planning

- Missed opportunities to consolidate purchasing for better terms

- Incomplete understanding of contractual risks facing the organization

- Difficulty assessing the impact of potential business changes on contractual obligations

- Lack of data to support optimization of contract terms

Contract Lifecycle Management platforms can significantly reduce contract review time and provide actionable insights for strategic planning, yet many organizations fail to leverage this advantage.

Transforming Contract Data into Strategic Insights

Elevating contracts to strategic assets requires moving beyond basic management to true intelligence. Implement analytics that identify spending patterns, risk exposures, and performance trends across your contract portfolio.

Establish regular reporting that brings contract insights to leadership discussions. Integrate contract data with other business systems to create a comprehensive view of your organization’s commitments and opportunities.

Contract risk management tools with AI capabilities can identify opportunities for term improvement, consolidation of agreements, and risk reduction. By transforming raw contract data into business intelligence, you enable leadership to make better-informed strategic decisions.

The Challenges of Traditional Contract Management Approaches

Traditional approaches—spreadsheets, shared drives, and physical storage—simply cannot address the complexity and volume of today’s contracting needs. These outdated methods create information silos, process inconsistencies, and visibility gaps that directly contribute to the risks we’ve discussed.

Common limitations include:

- Manual processes that consume excessive time and resources

- Fragmented storage that prevents comprehensive visibility

- Inconsistent tracking of key dates and obligations

- Limited collaboration capabilities among stakeholders

- Inability to scale as contract volume grows

- Poor integration with other business systems

- Lack of standardization across the organization

These fundamental challenges of contract management cannot be addressed through incremental improvements to outdated approaches. They require a comprehensive rethinking of how contracts are managed throughout their lifecycle.

Modern Solutions: Contract Risk Management Software

Technology has transformed how organizations manage contract risk. Today’s CLMs can act as contract risk management software solutions and offer comprehensive capabilities that address the core risks we’ve discussed through automation, centralization, and intelligence.

The most effective solutions provide:

- Centralized contract repositories with robust security and access controls

- Automated extraction of key terms, dates, and obligations

- Workflow automation that guides contracts through appropriate approval paths

- Template libraries with pre-approved language

- Electronic signature integration for faster execution

- Automated alerts for upcoming dates and milestones

- Reporting and analytics that provide management insights

- Integration with other business systems for comprehensive visibility

These technological capabilities fundamentally change how organizations approach contract risk management, enabling proactive management rather than reactive firefighting.

Essential Features of Effective Contract Risk Management Tools

When evaluating contract risk management tools, focus on capabilities that directly address your most significant risks. Look for:

- Intuitive interfaces that encourage adoption across the organization

- Flexible workflow configuration that adapts to your processes

- Robust security features that protect sensitive information

- Comprehensive search capabilities that find information quickly

- Automation that reduces manual effort and human error

- Analytics that convert contract data into actionable insights

- Integration capabilities that connect with your existing systems

- Mobile access for users who need information on the go

The right solution balances sophisticated capabilities with ease of use, ensuring that technology enhances rather than complicates your contract risk management process.

Malbek’s AI-Powered Approach to Contract Risk and Compliance

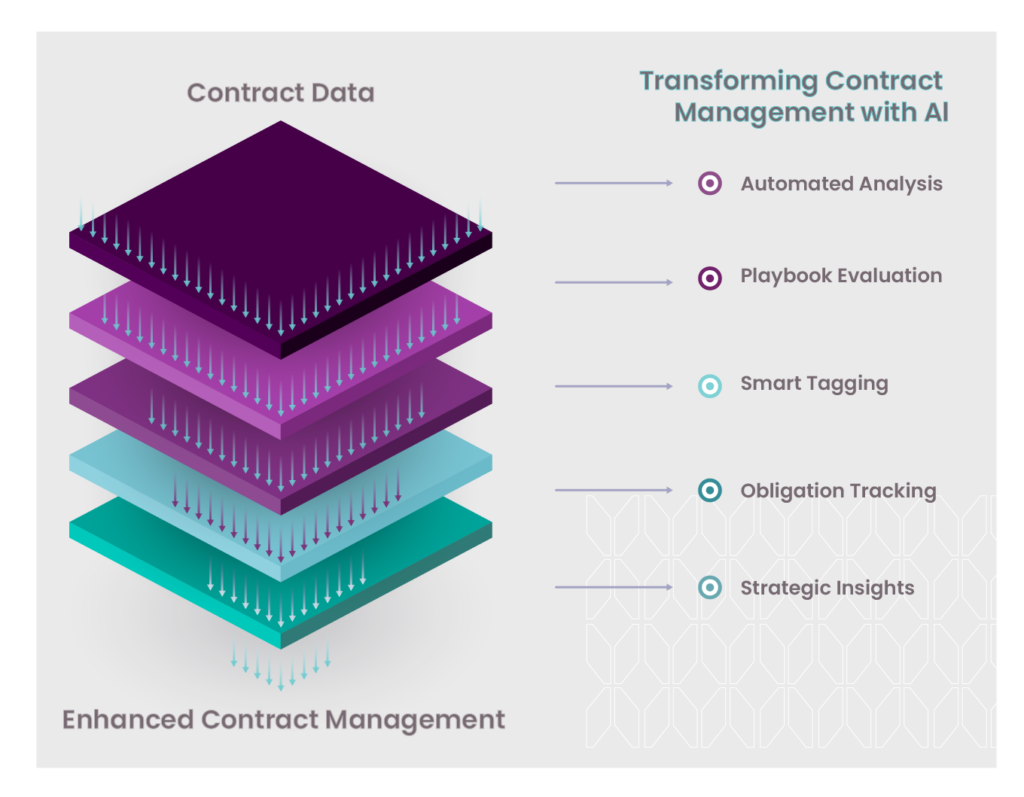

Malbek’s CLM platform offers a comprehensive approach to contract risk and compliance through advanced AI capabilities. The platform addresses the seven key risks we’ve discussed through a unique combination of features:

- Automated contract analysis that identifies financial terms and obligations

- AI-powered playbook evaluation that ensures compliance with internal standards

- Smart tagging that enables comprehensive visibility across the contract portfolio

- Intuitive workflows that eliminate operational bottlenecks

- Secure repository with role-based access controls

- Automated obligation tracking that strengthens business relationships

- Analytics that convert contract data into strategic insights

What sets Malbek apart is its AI-first approach, which transforms traditional contract management into an intelligence-driven strategic function. The platform doesn’t just store contracts—it actively helps identify risks, enforce standards, and capture value.

Ensemble LLM: A Breakthrough in Managing Contract Risk

At the core of Malbek’s approach is the innovative Ensemble LLM technology. This unique approach leverages multiple large language models working together to provide superior accuracy and reliability in contract analysis.

Malbek’s Ensemble LLM:

- Dynamically selects the appropriate LLMs for specific use cases

- Implements a “chain of verification” mechanism to validate outputs

- Leverages industry-leading AI from Azure OpenAI, AWS Anthropic, and AWS Mistral

- Uses confidence scoring to optimize model selection

- Employs Retrieval Augmented Generation for enhanced context awareness

This advanced technology enables unprecedented accuracy in risk identification, clause analysis, and obligation extraction, transforming how organizations manage contractual risk management.

Conclusion

Effective contract risk management is about creating a competitive advantage: By addressing the seven critical risks we’ve examined, you transform your contract portfolio from a potential liability into a strategic asset.

The organizations that excel in this area don’t view contract risk management as a compliance exercise but as a business imperative that touches every aspect of operations. They leverage technology to automate routine tasks while focusing human expertise on strategic analysis and relationship management.

By implementing the approaches we’ve discussed, you can recapture lost revenue, reduce legal exposure, eliminate operational inefficiencies, strengthen security, build stronger relationships, gain comprehensive visibility, and enable better strategic decision-making.

Ready to transform how your organization manages contract risk? Contact Malbek today to discover how our AI-powered CLM solution with Ensemble LLM technology can help you convert contract management challenges into strategic opportunities.