Contract Compliance Tracking and Reporting Guide for 2025

Contract compliance is the immune system of business relationships. Just as our bodies have evolved sophisticated defense mechanisms against ever-changing threats, contract compliance management has transformed dramatically to protect organizations in an increasingly complex business environment.

Digital transformation has revolutionized how organizations monitor adherence to contractual obligations. According to PwC and WCC (World Commerce & Contracting), organizations implementing CLM software experience an 80% reduced risk rate in contract compliance. By ensuring all compliance requirements are met, these systems significantly reduce the risk of financial penalties and legal issues.

The integration of artificial intelligence, blockchain for verification, and enhanced data analytics capabilities has transformed contract compliance from a reactive necessity to a proactive strategic advantage. Organizations now utilize these technologies to anticipate compliance issues before they arise, turning what was once considered a cost center into a value-generating function.

Understanding the Modern Contract Compliance Process

Just as a world-class orchestra requires precise tracking of each musician’s performance to achieve harmony, effective contract compliance demands meticulous monitoring of every obligation across your organization’s contractual landscape. When one contractual commitment slips through the cracks—like a missed deadline, overlooked service level agreement, or forgotten regulatory filing—the consequences can cascade throughout your business relationships, creating financial penalties, operational disruptions, and reputational damage.

The Anatomy of Modern Contract Compliance Tracking

The contract compliance tracking process has evolved into a sophisticated system that encompasses five critical phases:

Initial Contract Analysis and Risk Assessment

Beyond basic review, this involves systematic cataloging of all obligations, deliverables, and regulatory requirements into trackable metrics with assigned accountability and deadline parameters.

Compliance Protocol Implementation

Establishing automated notification systems, performance dashboards, and verification procedures that transform static contract terms into dynamic tracking mechanisms.

Real-Time Monitoring and Documentation

Deploying contract management software with customized KPIs to provide continuous visibility into compliance status, capturing evidence of performance, and maintaining audit trails.

Proactive Issue Detection and Remediation

Utilizing early warning systems and escalation protocols to identify potential non-compliance before deadlines are missed, with formalized resolution workflows.

Data-Driven Compliance Reporting

Generating comprehensive analytics that quantify compliance rates, identify recurring issues, and provide actionable insights for contract optimization.

This systematic approach transforms abstract contractual language into concrete, measurable actions that can be monitored across the contract lifecycle.

The Distributed Accountability Model

Modern contract compliance has transcended its traditional confinement within legal departments to become an enterprise-wide responsibility matrix. Advanced tracking systems now integrate with procurement, operations, finance, and customer success workflows, creating a distributed yet unified compliance ecosystem. This cross-functional approach ensures that specialized domain knowledge is applied to each compliance requirement while maintaining centralized visibility through integrated tracking platforms.

Key Stakeholders in Contract Compliance

Contract compliance requires a team effort with clearly defined responsibilities. The contract compliance officer typically serves as the primary overseer, responsible for developing compliance strategies and ensuring their implementation. They work closely with compliance managers who handle day-to-day monitoring and reporting activities.

Legal teams contribute their expertise on regulatory requirements and contractual interpretation, while finance departments track payment obligations and financial terms. Procurement teams ensure vendor compliance with service level agreements, and operations personnel verify that deliverables meet quality standards.

Executive leadership also plays a crucial role by setting the tone for compliance culture and providing necessary resources. Without top-level support, even the most well-designed compliance programs can falter.

Regulatory Frameworks Impacting Compliance Agreements

The regulatory environment continues to grow more complex, with implications for contractual compliance across industries. Privacy regulations like GDPR in Europe and CCPA in California have expanded to include more stringent data protection requirements that must be reflected in contracts.

Healthcare organizations face HIPAA compliance challenges that extend to their business associates, requiring robust contract provisions and monitoring. Financial institutions must address regulations like Basel III and AML requirements in their contractual frameworks.

Industry-specific regulations further complicate the compliance landscape, with pharmaceutical companies facing FDA guidelines, government contractors addressing FAR requirements, and technology companies navigating export controls and telecommunications regulations.

Organizations must now build these regulatory requirements directly into their contract compliance tracking systems to ensure continuous adherence rather than point-in-time compliance.

Effective Contract Compliance Tracking Methodologies

Remember the last time you tried to keep track of multiple commitments without some kind of system in place? Perhaps you missed a friend’s birthday or forgot an important deadline? Now imagine that on an organizational scale with hundreds or thousands of contractual obligations. Sounds overwhelming, doesn’t it? How do successful organizations manage to stay on top of all these moving pieces?

Effective tracking begins with a clear understanding of what needs to be monitored. This includes not only explicit contractual obligations but also implied terms, regulatory requirements, and performance expectations. Progressive organizations establish a comprehensive monitoring framework that addresses all these dimensions.

The most effective tracking methodologies leverage a combination of technology and human expertise. While AI and automation handle routine monitoring and data analysis, human judgment remains essential for interpreting complex contractual provisions and making nuanced compliance determinations.

Establishing Trackable Compliance Metrics and KPIs

Meaningful contract compliance tracking requires clearly defined metrics that quantify adherence to contractual obligations. These should include both lagging indicators that measure past performance and leading indicators that predict future compliance.

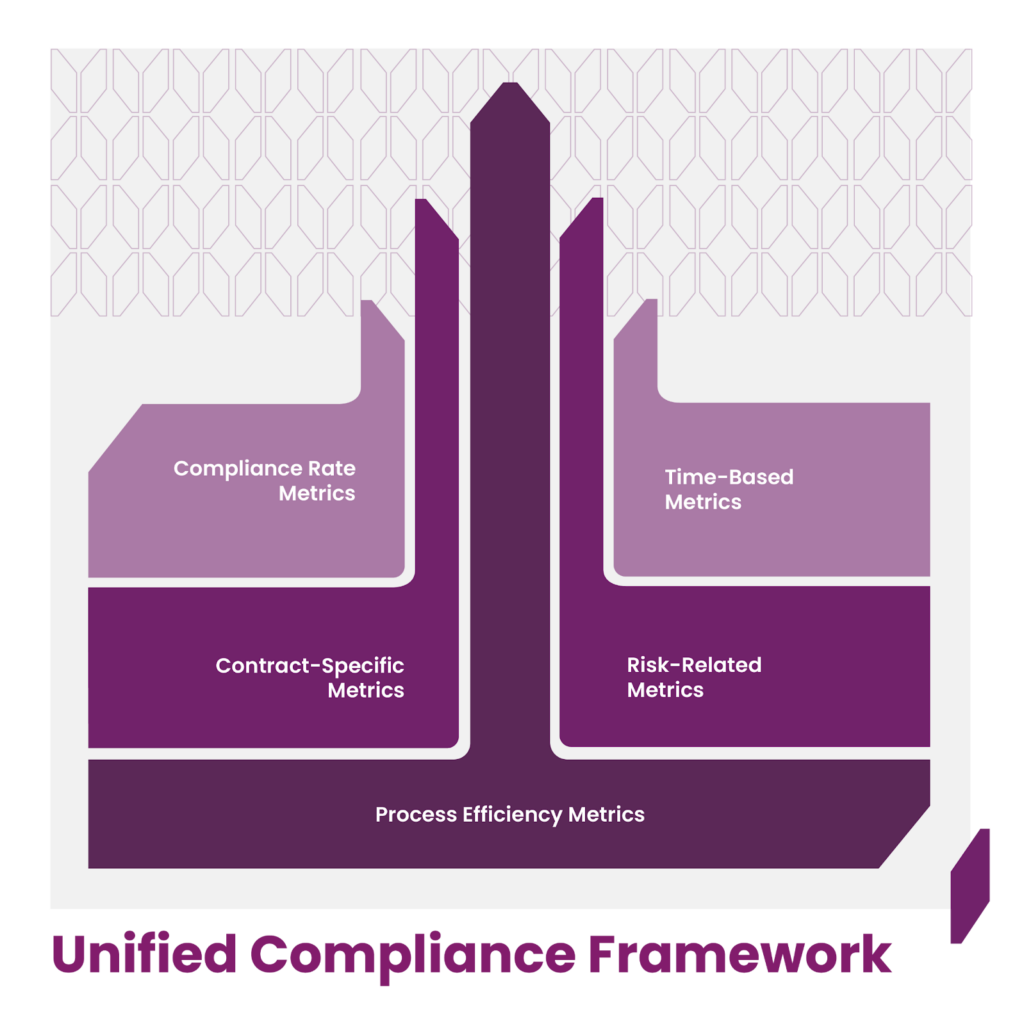

Alt-text: Infographic on the Malbek’s Unified Compliance Framework

Common compliance KPIs:

- Compliance Rate Metrics: Percentage of contracts with compliance issues, compliance audit scores, and proportion of contracts with up-to-date documentation

- Time-Based Metrics: Average time to resolve compliance gaps, time to address regulatory violations, and cycle time for compliance reviews

- Contract-Specific Metrics:

- For service contracts: SLA adherence rates and service quality measurements

- For procurement contracts: Delivery timeline compliance and quality standards

- For financial agreements: Payment timeliness and reporting requirement fulfillment

- Risk-Related Metrics: Number of regulatory violations, risk exposure scores, and compliance exceptions by severity

- Process Efficiency Metrics: Time spent on compliance activities, automation rate for compliance tasks, and resource allocation efficiency

The best compliance metrics align directly with business objectives, providing actionable insights rather than merely measuring activities. They should enable both operational monitoring and strategic decision-making.

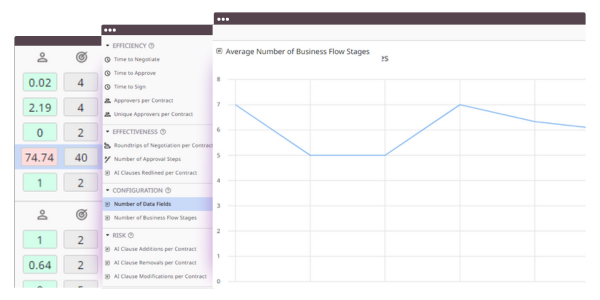

Automated Compliance Monitoring Tools

Automation has reimagined contract compliance tracking, enabling continuous monitoring rather than periodic reviews. AI-powered systems can now analyze contract language, track performance data, and compare actual outcomes against contractual requirements in real time.

These tools typically feature automatic alerts when compliance thresholds are breached, scheduled compliance verification workflows, and integration with contract management systems to ensure changes to agreements are reflected in compliance monitoring.

AI-augmented solutions use machine learning to improve detection accuracy over time, learning from patterns of compliance and non-compliance to anticipate potential issues. They can also prioritize alerts based on risk levels, ensuring attention is focused on the most critical compliance concerns.

The integration of these tools with other business systems—including ERP, CRM, and procurement platforms—creates a comprehensive compliance ecosystem that captures relevant data across the organization.

Contract Compliance Reporting Best Practices

What good is tracking compliance if nobody understands what the data means? Ever received a report filled with numbers and charts that left you asking, “So what?” The art of contract compliance reporting is transforming dry data into compelling stories that drive action.

Contract compliance reporting strikes a balance between comprehensiveness and clarity. Reports should provide sufficient detail for informed decision-making while remaining digestible for busy executives and operational teams.

The frequency and format of reporting should align with the needs of different stakeholders. Executive leadership may require monthly high-level summaries, while operational teams might need weekly detailed reports on specific contract categories or compliance metrics.

Visual elements also play an important role: Charts, graphs, and heat maps help recipients quickly grasp compliance status and trends, focusing attention on areas requiring intervention.

Creating Actionable Compliance Dashboards

The most effective compliance dashboards provide at-a-glance visibility into an organization’s compliance posture. They typically feature color-coded indicators of compliance status, trend lines showing compliance performance over time, and drill-down capabilities for detailed investigation.

Real-time dashboards have largely replaced static reports, allowing stakeholders to access current contract compliance information whenever needed. These interfaces typically include filtering options to focus on specific contract types, departments, or compliance categories.

Advanced dashboards incorporate predictive elements that forecast future compliance based on current trends and historical patterns. This predictive capability enables proactive intervention before compliance issues materialize.

Mobile-optimized dashboards ensure key stakeholders can monitor compliance status regardless of location, supporting timely decision-making even when team members are distributed or traveling.

Compliance Reporting for Different Stakeholders

Different stakeholders require different perspectives on compliance information. Executive leadership needs high-level risk assessments and trend analysis, while legal teams require detailed information on specific compliance issues and resolution status.

Procurement teams benefit from vendor-specific contract compliance reporting that highlights performance against contractual obligations. Finance departments need visibility into financial compliance, including payment terms adherence and financial reporting requirements.

Operational managers require practical compliance information relevant to their functional areas, focused on the contracts and obligations that impact their day-to-day activities. Regulatory teams need specialized reports on compliance with specific regulations and standards.

The most sophisticated reporting systems automatically tailor information to each stakeholder group, delivering personalized compliance insights that align with specific responsibilities and information needs.

The Contract Compliance Audit Process

Just as we need regular medical exams to catch potential health issues early, your contracts need periodic check-ups too. But what exactly should you be looking for, and how do you turn findings into meaningful improvements?

An audit process typically includes several phases:

- Planning and scoping

- Document collection and review

- Interviews with key stakeholders

- Compliance testing

- Findings documentation

- Recommendation development

This systematic approach ensures a thorough examination of compliance practices and outcomes.

External audits by independent firms provide an objective assessment of compliance status, while internal audits offer opportunities for ongoing improvement. Many organizations implement a combination of both approaches, with regular internal audits supplemented by periodic external reviews.

Preparing for a Contract Compliance Audit

Organizations should begin by clearly defining the audit scope—which contracts, compliance areas, and time periods will be examined—and establishing the criteria against which compliance will be assessed.

Documentation preparation includes gathering all relevant contracts, amendments, compliance records, correspondence, and performance data. Many organizations create audit preparation checklists to ensure nothing is overlooked.

Stakeholder preparation involves informing relevant team members about the audit process and their roles. This typically includes training on how to interact with auditors and address questions about compliance processes and outcomes.

Resources should be allocated appropriately, including dedicated staff time for supporting the audit and technology tools for efficient document management and information sharing. Proper preparation not only facilitates a smoother audit process but often leads to more accurate and useful findings.

Post-Audit Implementation Strategies

The true value of an audit lies in how effectively its findings are implemented. Organizations should establish a structured approach to reviewing audit results, prioritizing findings based on risk level and business impact, and developing action plans for addressing identified gaps.

Clear ownership of implementation activities is essential, with specific individuals or teams assigned responsibility for each recommendation. Implementation timelines should be realistic yet ambitious, with regular progress tracking to ensure momentum is maintained.

Root cause analysis of compliance gaps helps organizations address underlying issues rather than merely treating symptoms. This approach prevents the recurrence of similar problems in the future.

Follow-up audits or reviews should be scheduled to verify that implementation has been effective and that compliance improvements have been sustained. This creates a continuous improvement cycle that progressively strengthens compliance practices.

Risk Management in Contract Compliance

Contract compliance and risk management exist in a symbiotic relationship—like two dancers moving in perfect coordination. It reduces risk exposure, while risk management approaches help prioritize compliance activities and resources.

The integration of risk management principles into compliance processes enables organizations to focus attention on the contracts and obligations that present the greatest potential for harm. This risk-based approach ensures efficient use of limited compliance resources.

Leading organizations have moved beyond reactive risk management to develop predictive capabilities, identifying potential compliance issues before they materialize and implementing preventive measures.

Identifying and Mitigating Contract Compliance Risks

Systematic risk identification begins with comprehensive contract analysis to understand obligations, dependencies, and potential failure points. This analysis should consider both explicit contractual requirements and implicit expectations.

Risk assessment techniques include probability-impact analysis, scenario planning, and failure mode effects analysis. These approaches help organizations understand which compliance risks warrant the greatest attention and resources.

Common mitigation strategies include contractual protections like limitation of liability clauses, insurance requirements, and performance guarantees. Operational mitigations might include enhanced monitoring, additional controls, or contingency planning.

Regular risk reassessment is essential as business conditions, regulatory requirements, and contractual relationships evolve. What was once a low-risk area may become high-risk due to changing circumstances.

Using AI to Strengthen Contract Risk and Compliance Protocols

Artificial intelligence has transformed risk identification by analyzing vast quantities of contract data to identify patterns and anomalies that might escape human notice. Machine learning models can now predict potential compliance failures based on historical performance and current indicators.

Natural language processing capabilities enable AI systems to interpret complex contractual language and identify obligations, risks, and ambiguities. This automated analysis helps organizations understand their compliance requirements more thoroughly.

Malbek’s Ensemble LLM approach exemplifies this advanced AI application, leveraging multiple large language models working in tandem to deliver enhanced accuracy and reliability in contract analysis. This multi-model approach allows for a more robust interpretation of complex contractual language.

For example, when addressing questions about price protection provisions in contracts, Malbek’s AI first retrieves relevant context using Retrieval Augmented Generation (RAG), then processes this information through their LLM system. The system employs a sophisticated approach where multiple models work together with confidence scoring that helps improve the reliability of the output.

Malbek’s AI-powered smart tagging and clause assessment capabilities automatically identify crucial clauses and evaluate their favorability, helping teams quickly identify terms that may present compliance risks. Combined with Malbek’s automated playbook execution, these systems can help organizations identify potential compliance issues as part of their contract management processes.

The combination of human expertise and AI capabilities like those offered by Malbek creates a powerful approach to risk management—machines handle data analysis and pattern recognition at scale, while humans provide strategic direction and nuanced judgment in addressing the identified compliance risks.

Wrap Up

What separates organizations that merely check compliance boxes from those that truly excel? How can you transform contract compliance from a necessary burden into a strategic advantage? Where should you begin your journey toward compliance excellence?

As we’ve explored throughout this guide, contract compliance tracking and reporting have evolved from necessary administrative functions to strategic business capabilities. Organizations that excel in these areas gain competitive advantages through reduced risk, stronger relationships, and more efficient operations.

Compliance excellence begins with understanding your current capabilities and challenges. Assess your existing processes against the best practices outlined in this guide, identifying gaps and opportunities for improvement.

Technology investment should align with your specific compliance needs and organizational context. While advanced AI and analytics offer powerful capabilities, even basic automation can significantly enhance compliance effectiveness compared to manual processes.

Remember that technology alone cannot ensure compliance success. The human elements—expertise, judgment, and collaboration—remain essential components of an effective compliance program.

By combining technological capabilities with human expertise, clear processes, and cross-functional collaboration, your organization can develop a compliance posture that not only protects against risks but also contributes to business success.

Contract compliance, when executed effectively, becomes more than a defensive measure—it becomes a positive force that strengthens relationships, enhances reputation, and creates sustainable business value.To see how Malbek’s AI-powered contract management platform can transform your compliance processes, schedule a personalized demo today. Experience firsthand how the right technology partner can help you mitigate risk while maximizing the value of your contractual relationships.